The "Negotiable Instruments Act, 1881" (N.I. Act) is an important piece of legislation in India that deals with promissory notes, bills of exchange, and cheques. It provides a legal framework for the use and enforcement of these negotiable instruments. Here's an overview of the key provisions and concepts under the Negotiable Instruments Act:

Purpose and Scope:

Regulation of Negotiable Instruments

- The N.I. Act regulates three main types of negotiable instruments:

- Promissory Notes

- Bills of Exchange

- Cheques

Commercial Transactions

- These instruments are commonly used in commercial and financial transactions to facilitate payments, borrowing, and lending.

Types of Negotiable Instruments:

Promissory Note

- A promissory note is a written promise to pay a specified sum of money to a specific person or bearer at a designated time or on demand.

- It contains an unconditional undertaking to repay a debt.

Bill of Exchange

- A bill of exchange is an unconditional written order by one party (the drawer) to another party (the drawee) to pay a specified sum of money to a third party (the payee).

- It involves three parties: the drawer, the drawee, and the payee.

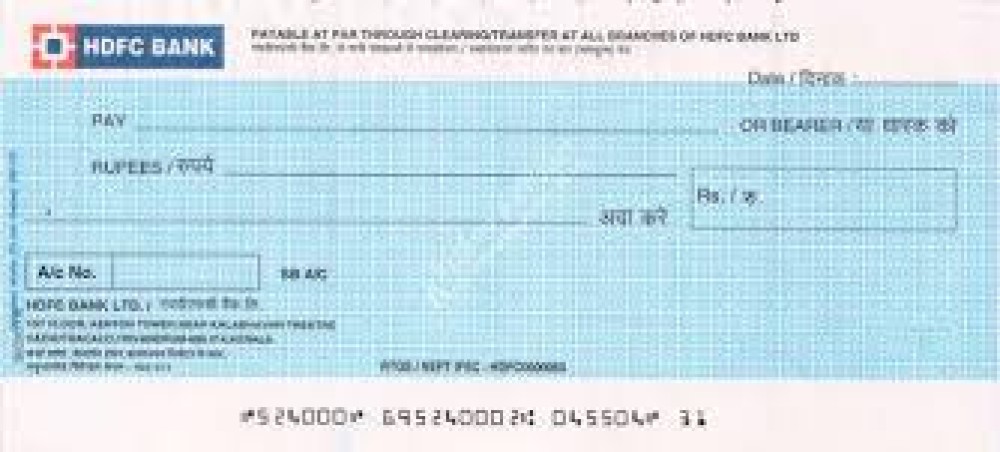

Cheque

- A cheque is a written order by an account holder (drawer) to their bank to pay a specified amount of money to the person named on the cheque (payee).

- It is used for making payments from a bank account.

Key Provisions of the N.I. Act:

Definition of Terms

- The Act defines various terms related to negotiable instruments, such as "holder," "holder in due course," "endorsement," "negotiation," etc.

Liability of Parties

- The N.I. Act specifies the liabilities and obligations of the parties involved in negotiable instruments:

- The drawer (maker) of a promissory note or bill of exchange

- The drawee of a bill of exchange

- The payee (holder) of a negotiable instrument

- The endorser and endorsee of a negotiable instrument

Negotiation and Endorsement

- The Act provides rules for the negotiation and endorsement of negotiable instruments.

- Endorsement allows the transfer of rights in the instrument to another party.

Presentment for Payment

- A holder of a negotiable instrument must present it for payment to the drawee (in the case of a bill) or the bank (in the case of a cheque) within a reasonable time.

- Failure to present the instrument for payment may result in loss of rights against parties liable on the instrument.

Dishonor and Notice

- If a negotiable instrument is dishonored (not paid) due to insufficient funds, the holder must give notice of dishonor to the parties liable on the instrument.

- The Act specifies the requirements for giving notice and the consequences of failure to give notice.

Liability of Parties in Case of Dishonor

- Parties to a negotiable instrument are held liable in case of dishonor, subject to certain conditions and defenses.

- Liability may include payment of the amount due, plus interest and costs.

Penalties for Offenses

- The N.I. Act also contains provisions for penalties in case of offenses related to negotiable instruments, such as forgery, alteration, or fraudulent use.

Importance of the N.I. Act:

Legal Framework

- The Act provides a clear legal framework for the use, transfer, and enforcement of negotiable instruments.

- It helps regulate and facilitate commercial transactions by providing certainty and predictability in financial dealings.

Protection of Rights

- The Act protects the rights of holders and parties to negotiable instruments.

- It establishes rules for negotiation, endorsement, presentment, and payment, ensuring that transactions are conducted fairly and efficiently.

Enforcement of Obligations

- The N.I. Act allows for legal remedies in case of dishonor or non-payment of negotiable instruments.

- It provides mechanisms for recovering amounts due, along with interest and costs, through civil courts.

Promotes Financial Transactions

- By providing a reliable and secure framework for financial transactions, the Act promotes trust and confidence in the use of negotiable instruments.

- It encourages the use of promissory notes, bills of exchange, and cheques in commerce and trade.

Legal Compliance and Due Diligence:

Proper Drafting

- It is important to ensure that negotiable instruments are properly drafted, with all essential elements and terms clearly stated.

- This helps avoid ambiguity and ensures enforceability.

Adherence to Procedures

- Parties involved in negotiable instruments must adhere to the procedures and timelines specified in the Act.

- This includes proper endorsement, presentment, and notification of dishonor.

Awareness of Rights and Liabilities

- It is crucial for holders and parties to negotiable instruments to be aware of their rights, obligations, and potential liabilities under the N.I. Act.

- This includes understanding the consequences of dishonor, liability in case of fraud, and the process for recovery of amounts due.

Legal Advice

- Parties involved in complex financial transactions or disputes related to negotiable instruments should seek the advice of legal professionals.

- A lawyer can provide guidance on compliance with the N.I. Act, legal remedies in case of disputes, and representation in legal proceedings.

In conclusion, the Negotiable Instruments Act, 1881 plays a crucial role in regulating the use and enforcement of promissory notes, bills of exchange, and cheques in India. It provides a legal framework that promotes trust, efficiency, and fairness in commercial transactions, while also establishing rights, obligations, and liabilities for parties involved in negotiable instruments. Compliance with the Act, proper drafting of instruments, and legal due diligence are essential for businesses and individuals engaging in financial transactions governed by the N.I. Act.